The Lara Property is considered to hold excellent potential for the establishment of sufficient reserves to justify a mining operation

- R.J. Bailes

Quote from the Abermin Corp’s Presentation at the 93rd Annual of Northwest Mining Association Convention Spokane, Washington, December 3, 1987

Overview

Region

Market

Opportunity

Managment

About Nova Pacific

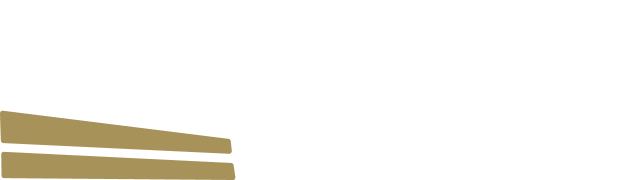

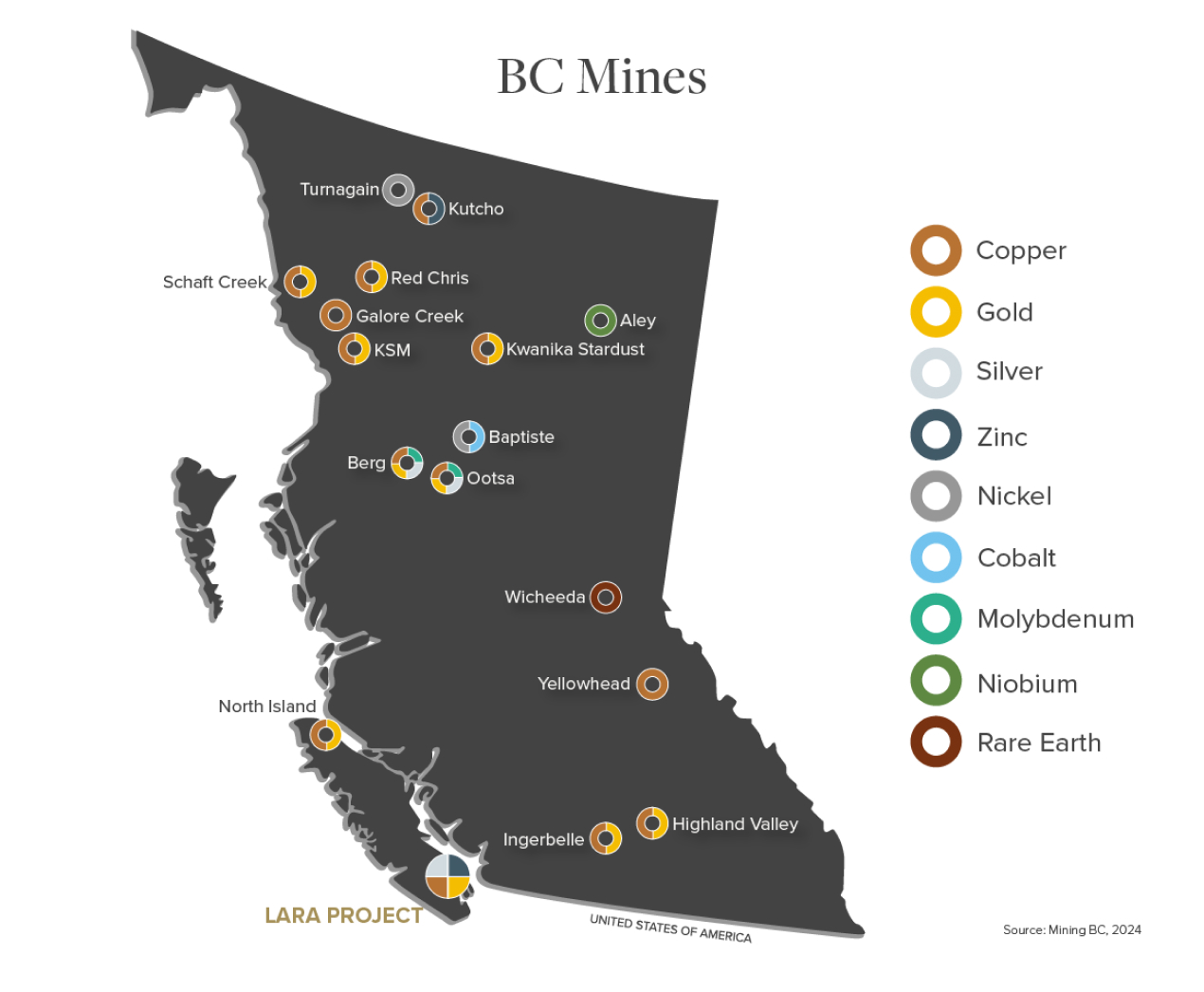

British Columbia - A Tier 1 Mining Jurisdiction with Rich Mining Heritage

Lara VMS

The Market

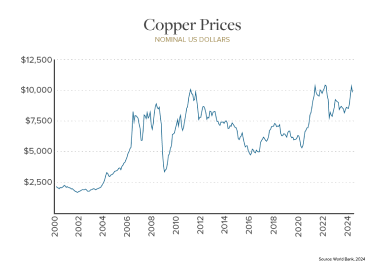

Copper

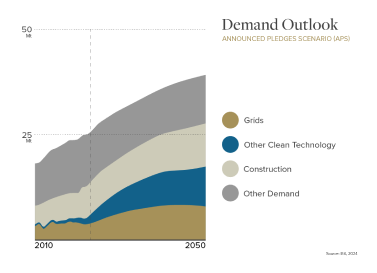

Copper demand is forecasted to surge due to its critical role in green technology transitions, such as renewable energy and electric vehicles, alongside industrial and infrastructure needs. This heightened demand is driving copper prices upward, resulting in an overall positive price trajectory. Additionally, supply constraints and geopolitical factors further support the price increase.

Copper Price as of July 2024

Price Increase since Jan 2000

Copper is the only critical mineral present in all of the most important clean energy technologies – EVs, solar PV, wind, and electricity networks – due to its unmatched combination of characteristics: electronic conductivity, longevity, ductility and corrosion resistance.

China is the fourth-largest producer with 8% of global supply while Russia supplies 5%

—International Energy Agency, Critical Minerals Outlook (2024)

Gold

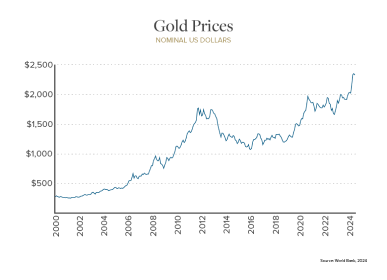

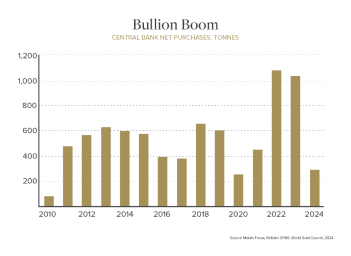

In 2024, gold prices have set new highs due to economic uncertainty, geopolitical tensions, and monetary policies. Rising inflation and recession fears have driven investors toward gold as a safe-haven asset. Additionally, increased demand from emerging markets and central bank purchases have further supported the price surge.

Gold Price as of July 2024

Price Increase since Jan 2000

Across all metals, we have the highest conviction on a bullish medium-term forecast for both gold and silver over the course of 2024 and into the first half of 2025, though timing an entry will continue to be critical

—Gregory Shearer, Head of Base and Precious Metals Strategy at J.P. Morgan.

Silver

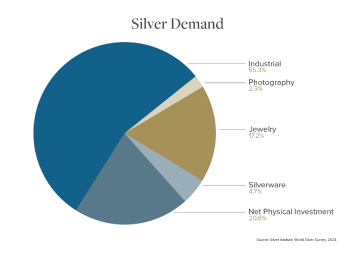

Silver prices are partially driven by its essential role in industrial applications and renewable energy technologies, particularly solar panels. Additionally, continued economic recovery and increased investment demand are expected to support silver prices.

Silver Price as of July 2024

Price Increase since Jan 2000

The global silver deficit is expected to rise by 17% to 215.3 million troy ounces in 2024 due to a 2% growth in demand led by a robust industrial consumption and a 1% fall in total supply

—Silver Institute Industry Association

The future is bright for silver with respect ot its use in green energy transition. Also there is further room for gold prices to go higher and silver prices will follow as well.

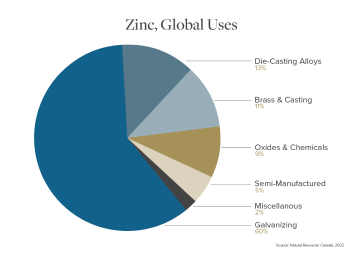

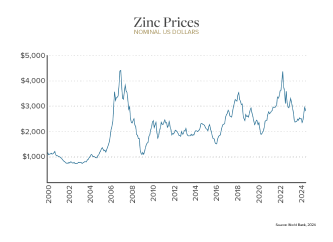

Zinc

The global zinc market has seen notable growth and volatility in recent years. As a vital metal used across industries such as construction, automotive, and electronics, zinc plays a critical role in economic development. This essentiality underscores its importance in driving industrial and technological advancements.

Zinc Price as of July 2024

Price Increase since Oct 2001

The usage of zinc in the rechargeable battery sector is set to grow exponentially this decade.

USD 26.64 billion in 2022 and is poised to grow from USD 29.73 billion in 2023 to USD 64.10 billion by 2030, at a CAGR of 11.6% during the forecast period (2023-2030)…Zinc is an essential metal used in various industries, including construction, automotive, and electronics, making it a crucial component for economic development.

Leadership

Advisory Board